Should you subscribe or avoid AGS Transact IPO? It will be out on Jan 19th, 2022, and closes on Jan 21st, 2022. Below are some of the important dates and details:

|

IPO Details |

Dates |

|

IPO open date |

Jan 19, 2022 |

|

IPO close date |

Jan 21, 2022 |

|

Price band |

Rs 166 – Rs175 |

|

Minimum lot quantity |

85 |

|

Allotment date |

Jan 27, 2022 |

| IPO listing date |

Feb 1, 2022 |

Table of Contents

Purpose of usage of AGS Transact IPO funds:

Below are the ways how the company intends to use the proceeds from IPO.

- Offer for Sale – The existing shareholders will receive the proceeds from selling their shares to the public.

- Enhance the company’s brand name and increase demand for equity shares in the Indian market.

Background & Business – AGS Transact IPO:

AGS Transact is one of the leading payment and cash solution providers to banks and corporates. AGS has two major subsidiaries – Securevalue India Limited (SVIL) engaged in the business of cash management services, India Transact Services Limited (ITSL) engaged in the business of creating and dealing with electronic payment systems. In addition to SVIL and ITSL, AGS has also started expanding its operations to Southeast Asia and other countries by forming overseas step-down subsidiaries in Sri Lanka, the Philippines, and Cambodia through subsidiaries in Singapore.

They provide customized products and services consisting of ATM and CRM outsourcing, cash management, and digital payment solutions including merchant solutions, transaction processing services, and mobile wallets.

The business segments are majorly divided into below categories:

- Payment Solutions;

- Banking Automation Solutions; and

- Other Automation Solutions (for customers in the retail, petroleum, and color sectors).

COVID Impact on Business – AGS Transact IPO:

Covid-19 impacted AGS Transact business operations especially when lockdown became operational during the first wave. Though the ATMs and cash services were listed under essentials and were operational even throughout the lockdown, it still affected the business adversely as below:

- Reduced cash usage due to pandemic, thus decreased ATM transactions.

- Decreased usage of our POS-based solutions across our POS network

- Increased cyber security breaches and crime rates.

However, the company strategized towards the digitalization of its services. There was a sudden spike of traffic on digital platforms, transactions which made it necessary to increase the bandwidth to serve all without any downtime. Covid has transformed the business in a way making digital payments, services, transactions more user-friendly and popular amongst the masses.

Government incentives – AGS Transact IPO:

- Discounts on digital payments – The government has announced discounts of 0.75% on digital payments methods at petrol pumps, thus discouraging cash transactions.

- Promoting Digitalization – The direct benefit transfer program under which the Government pays subsidies and wages using digital payment platforms.

- Cyber Surakshit Bharat – The Ministry of Electronics and Information Technology (MeitY) announced the Cyber Surakshit Bharat initiative in association with National e-Governance Division (NeGD) and industry partners in 2018. It is an initiative to fortify the cybersecurity system in India.

- Pradhan Mantri Jan-Dhan Yojana (“PMJDY”) – Promote financial inclusion. Provide banking solutions to people living in villages and rural areas.

Forecasted Growth – AGS Transact IPO:

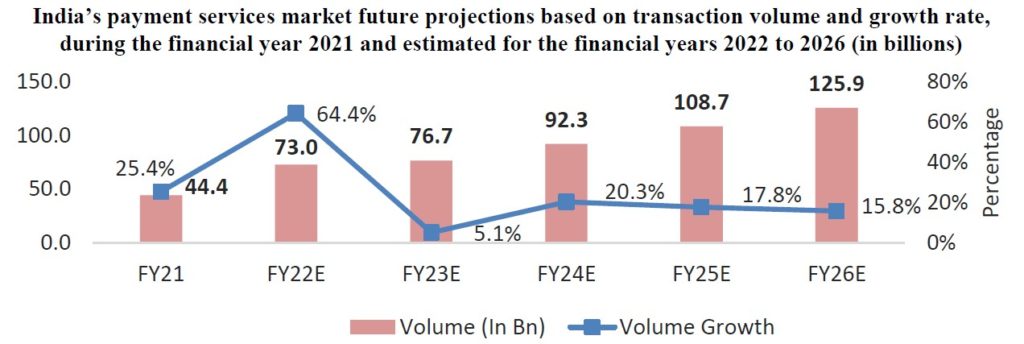

The Indian payment services market is expected to grow from $44.4 Billion in 2021 to $125.9 Billion in 2026.

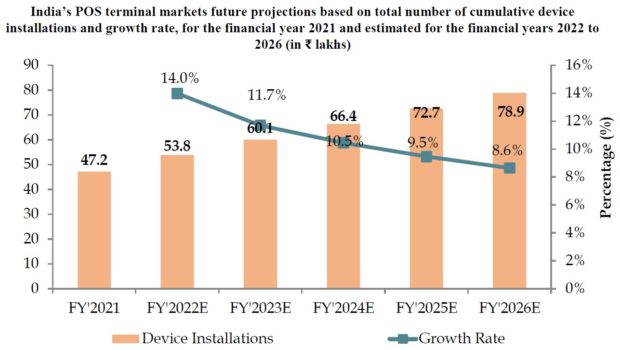

India POS terminal market size has grown at a CAGR of 27.7% in the last 5 years. It is expected to multiply further at the same rate. The device installations will increase from 47.2 lakhs in 2021 to 78.9 lakhs in 2026.

Below are the factors responsible for such growth:

- Cashless transactions – Due to pandemic, people prefer cashless transactions thus digital payments are being preferred. In the coming years, cashless transactions and digital payment will rule the market.

- Growth of e-commerce platforms – A large number of companies are selling products and services online. Thus, the online mode of payments is easy, a click away. In near future, people will prefer one-click purchases anywhere, and get the products delivered at their doorsteps.

- Growth of retail stores – With the increase in retail stores, POS terminals are likely to increase.

- Cost control – Digital payments offer automation thus saving time, energy, cost of additional labor. The electronic payment system has streamlined the manual processes, thus saving additional operational costs incurred in managing manual processes.

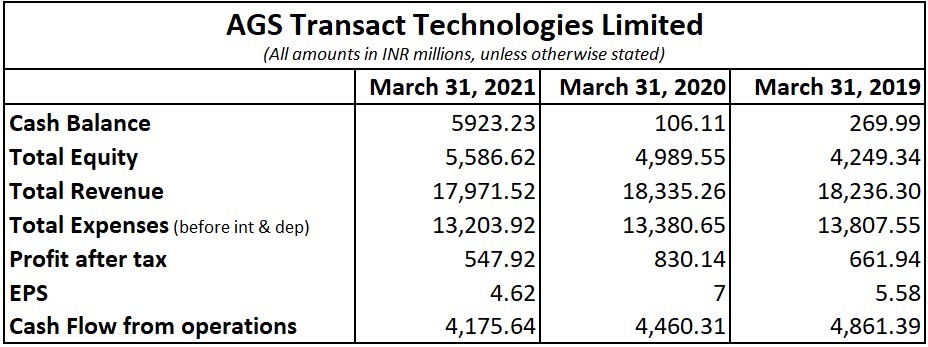

Financial Highlights & trends (2021-2019)

- Cash Balance – Total cash balance increased by 2094% in 2021

- Total Equity also increased by 31% in 2021

- Total Revenue decreased by 1%

- Total Expenses decreased by 4%

- Profit after tax decreased by 17%

- Cash Flow from operations decreased by 14%

Below are inferences:

- Cash balance has multiplied, thus the company is cash-rich

- Equity has also increased in these 3 years

- Total revenue has been slightly lower

- Profit after tax has been reduced significantly and as of August 2021, the company has reported losses of 181.05 million which may turn the company into losses for 2021.

- Cash flow from operations also show a declining trend

Download prospectus filed with SEBI

AGS Transact IPO – Subscribe or Not?

No, we do not recommend you to subscribe to AGS Transact IPO for the short term but for the long term.

Why subscribe for the long term?

The forecasted growth looks promising but considering recent losses, and offer for sale as objective, you may avoid this IPO for the short term.

- Losses were reported till August 2021, thus a profit-making company turned into a loss-making company.

- Decreasing EPS and return on net worth.

- Offer for sale as the primary purpose

- No GMP, no movement in IPO Grey market

However, from a long-term perspective, this company looks attractive, but the long term maybe 2 years from now.

Strengths of AGS Transact IPO

- Growing income and online literacy level of people in India

- Increased usage of Online portals to purchase anything and everything

- Government Initiatives for Indian payment services and POS terminal market

Challenges of AGS Transact IPO

- Higher operational and finance costs thus the company will be left with squeezed profit margins

- High competition from established competitors

- Comply with various national and local laws and regulations

- Competitive pricing

The challenges listed overweighs the strengths called out. Thus, we do not recommend subscribing to AGS Transact IPO.

Short-term or Long-Term Hold?

If you still want to buy AGS Transact IPO shares then go for the long term. As holding these for the short term might not give you desired appreciated value.

We recommend you enroll in our Stockbroker trading course which will help you to pick the rewarding IPO and earn huge profits.

What is your opinion about AGS Transact IPO?

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing or consult our financial advisor 😊