Should you subscribe to CarTrade Tech Limited IPO? It will be out on August 9th, 2021, and closes on August 11th, 2021. Below are some of the important dates and details:-

| IPO Details | Dates |

| IPO open date | August 9, 2021 |

| IPO close date | August 11, 2021 |

| Price band | Rs 1585-Rs1618 |

| Minimum lot quantity | 9 |

| Allotment date | August 17, 2021 |

| IPO listing date | August 23, 2021 |

Table of Contents

Background & Business- CarTrade Tech Limited IPO

CarTrade Tech Limited IPO is a multi-channel auto platform that operates under several brands: CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto, and AutoBiz. Through these platforms, they enable new and used automobile customers, vehicle dealerships, vehicle OEMs, and other businesses to buy and sell their vehicles in a simple and efficient manner. Car shoppers may visit CarWale and CarTrade platforms to research and connect with dealers, OEMs, and other partners to sell and buy cars from the large variety of new and used cars offered by them. In addition, they engage with financing and automotive ancillary companies to offer their products and services on CarWale and CarTrade. Customers looking for new and used two-wheelers can research and connect with dealers, OEMs, and other partners on BikeWale to sell and buy two-wheelers. Shriram Automall facilitates sales of pre-owned cars, two-wheelers, commercial vehicles, four-wheelers, and farm and construction equipment.

COVID Impact on Business

Due to the COVID-19 pandemic, there has been a strong incline towards using personal vehicles as compared to public transport or shared mobility. Personal mobility demand weakened during the first few months of the COVID-19 pandemic, then rebounded quickly after the “unlock” phases, as consumers preferred self-owned vehicles to ensure social distancing and reduce dependence on a weak public transport system. In addition, restrictions on travel and the downward trend in other discretionary spending have caused a shift towards spending on vehicle ownership. The general trend was for consumers to browse vehicles online and then visit brick-and-mortar dealerships to make the final purchase. According to a Google report entitled “Auto Gear Shift India 2020: Purchase Journey of a Four-Wheeler Buyer in India” (“Auto Gear Shift India 2020”), 92% of new and used car buyers and 86% of used car sellers rely on online channels during their buying and selling journey.

Government Initiatives

- Production Linked Incentive (PLI) Scheme – To enhance India’s manufacturing capabilities in the automobile and automotive component sectors and exports under Atma Nirbhar Bharat, the GoI has announced a cost of ₹ 750.00 billion for automobiles and components (including batteries) under the new PLI scheme. Because automobiles account for more than 40% of India’s manufacturing GDP, the PLI scheme aims to acts as a catalyst to accelerate domestic manufacturing & boost exports.

- FAME India Scheme Phase II: The FAME India Scheme II is proposed to be implemented over three years from April 1, 2019, to promote faster adoption of electric mobility and the growth of electric and hybrid technology. In February 2019, the GoI approved the FAME-II scheme with a fund requirement of US$ 1.39 billion for financial years 2020 to 2022.

- National Automotive Testing and R&D Infrastructure Project (“NATRIP”): To enable the automotive industry to adopt and implement global performance standards and to develop India as a global manufacturing center and a Research and Development (“R&D”) hub, the GoI established NATRIP at a total cost of US$ 573 million. The main focus is to provide low-cost manufacturing and product development solutions.

- New scrappage policy: To encourage owners to scrap vehicles older than 15 years and purchase new ones, the GoI offers financial or tax-based benefits to consumers purchasing new vehicles. Purchasers of new vehicles who are scrapping their old vehicles in the same vehicle category are exempt from paying fees for a registration certificate and assignment of a new registration mark for their new vehicles.

Forecasted Growth

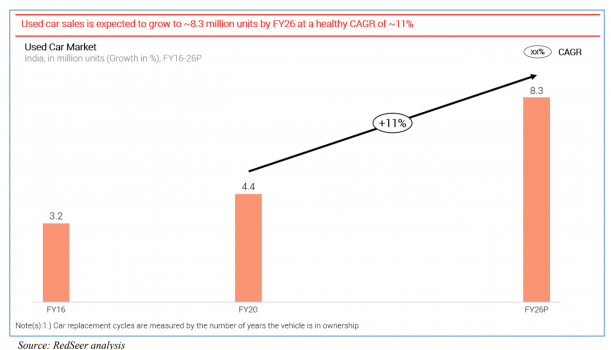

Trends such as decreasing replacement cycles and increasing preference of first-time buyers for used cars due to, among other reasons, a desire to limit the use of public transport because of COVID-19, are expected to fuel the growth of the used car market in India. The used car market in India is expected to grow at a CAGR of at least 11% in the next five years, from its current size of approximately 4.4 million cars in the financial year 2020 to approximately 8.3 million cars in the financial year 2026.

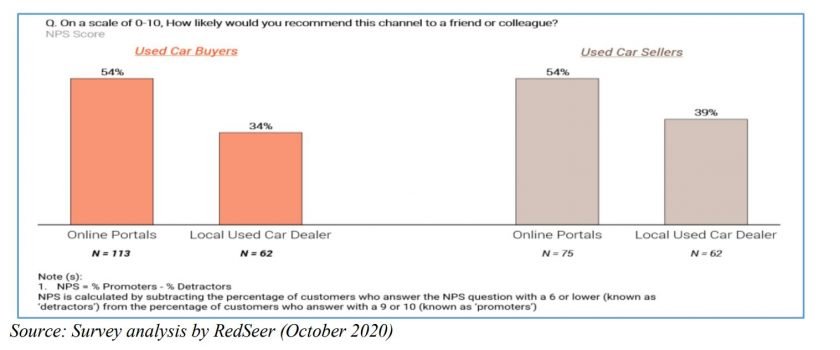

Online platforms are also rated highest by used car sellers across all parameters, reflecting their preference for selling used cars.

Reasons for forecasted growth:

- High Online Platform usage

- Buy Used vehicles through organized sectors

- Preference to drive self-owned vehicles & avoid shared mobility services due to Covid.

Financial Highlights & trends (2018-2021)

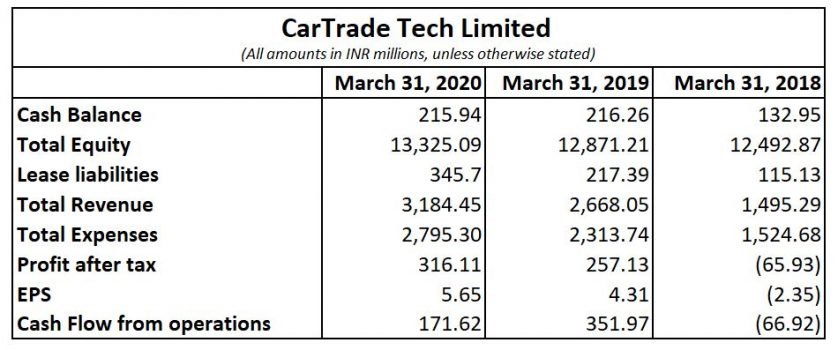

- Cash Balance – Total cash balance increased by 62% in 2020 vs in 2018

- Total Equity also increased by 7% in 2020

- Lease liabilities increased by 200%, whereas finance cost associated with lease increased by 611%

- Total Revenue increased by 113%

- Total Expenses increased slightly by 83%

- Profit after tax increased by 579%

- Cash Flow from operations witnessed an increase of 356%, it turned positive in 2019

Inferences

- The company’s revenue increased due to the rise in demand for self-owned vehicles & usage of online portals

- Expenses have increased but the increase is less than revenue increase, thus beating inflation

- Company borrowings have increased due to increased leased facilities

- Surplus cash has slightly increased, it always helps in absorbing any shocks or meeting emergency situations

- Cash Flow from operations has been positive in consecutive 2 years, the increase is significant as it turned from negative in 2018 to positive in 2019 & 2020

- PAT has significantly increased since the losses have turned to profits from 2019

CarTrade Tech Limited IPO – Subscribe or Not?

Yes, We recommend you to subscribe to CarTrade Tech Limited IPO. Looking at its promising growth forecasts & good financials.

Stock Market Tip– Do subscribe to CarTrade Tech Limited IPO

Strengths of CarTrade IPO

- Growing income of middle class & upper middle class is accelerating demand for used cars

- The growing market of owning vehicles post covid to avoid shared transport facilities

- Increased usage of Online portals to purchase used cars/accessories/financing services

- Government Initiatives for the automobile industry

Challenges of CarTrade IPO

- Leased sites for operating auto malls are expensive due to high operation & finance cost

- High competition from established competitors

- Comply with various national and local laws and regulations relating to the protection of the environment

- Competitive pricing

The strengths listed overweighs the challenges called out. Thus, we highly recommend subscribing to CarTrade Tech Limited IPO.

Short term or Long-Term Hold

We recommend holding CarTrade Tech Limited IPO shares for the long term. As demand for Used cars & related service has increased in preference to avoid shared transport facilities & high internet usage. Thus, holding for the long term will help you multiply your money. These shares also look good from receiving a Dividend. Holding these for the short term might only give you listing gains.

We recommend you enroll in our Stock broker trading course which will help you to pick the rewarding IPO and earn huge profits.

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing.

Buy Graphics Tablet to write and draw