Should you subscribe to Glenmark Life Sciences IPO? It will be out on July 27, 2021, and closes on July 29, 2021. The company and its shareholders seek to raise Rs 1,514 crore from primary market investors. Below are some of the important dates and details:

| IPO Details | Dates |

| IPO open date | July 27, 2021 |

| IPO close date | July 29, 2021 |

| Price band | Rs 695-Rs720 |

| Minimum lot quantity | 20 |

| Allotment date | August 3, 2021 |

| IPO listing date | August 6, 2021 |

Table of Contents

Company Background

Glenmark Life Sciences is a leading developer and manufacturer of select high-value, non-commoditized active pharmaceutical ingredients (“APIs”) in chronic therapeutic areas, including cardiovascular disease (“CVS”), central nervous system disease (“CNS”), pain management, and diabetes. It is a wholly-owned subsidiary of Glenmark Pharmaceuticals Limited (GPL). The API business was transferred to a 100% subsidiary of GPL on 1 January 2019. GPL’s API business was established in 2003 for captive consumption and the export sale of APIs. APIs produced are exported to multiple countries in Europe, North America, Latin America, Japan, and the rest of the world.

COVID Impact

The pandemic had increased demand for APIs & has shed light on India’s excessive dependence on China for APIs and KSM. India’s pharma industry is also trying to engage in backward integration for the manufacturing of APIs as it wants to shift its reliance from China and become self-sufficient in the coming years. The production and supply chains of major pharmaceutical companies were slowed due to pandemic.

Credit Rating

Credit Rating as per India Ratings & Research as of November 2020 is A with a Stable outlook, and the previous 1 year’s rating has also been stable with no red alert.

Forecasted Growth

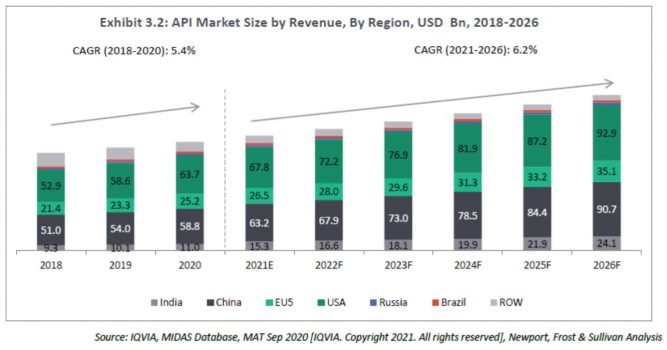

As per the sources, the API market shows the CAGR of each region for the historic and forecast periods. The global API market grew at a CAGR of 5.4% during the historic period and is expected to grow at a CAGR of 6.2% in the next five years. From 2021 to 2026, India, China, and the USA are expected to show the highest growth rates of about 9.6%, 7.5%, and 6.5%, respectively. EU5 countries and Russia are also expected to show a healthy growth rate of about 5.7% and 5.5%, respectively, over the next five years. The Asia Pacific API market is evaluated to be the fastest-growing market like India, China and South Korea are developing as main hubs for outsourcing drug manufacturing.

Financial Highlights from 2019 to 2020

- Inventories – It increased by 3% from 2019. Signifies high demand for products

- Increased Sales on Credit– trade Receivables increased by 42.5%. This implies sales on credit was high

- Cash Balance – Total cash balance increased by 485%. Thus this company turned cash rich

- Total Equity also increased by 356%

- Borrowings remains constant

- Total Revenue increased by 75%

- Total Expenses increased on similar grounds by 71%

- Total Profit after Tax increased by 60%

- Total Cash Flow increased by 385%, contributed by Cash flow from Operations which increased by 1784% only

Below are inferences –

- This company was able to increase its revenue by 75%, but at the same time was not able to reduce the expenses by beating inflation, since the expenses grew at the same rate of 71%

- Company borrowings were stagnant which is good for long run

- Sales have increased taking route of credit sales and taking advantage of working capital management in efficient way.

- Surplus cash always helps in absorbing any shocks or meeting emergency situations

- Cash Flow from operations increased by 1784% but PAT did not increased equivalent to that. This is because cash flow from investing and financing activities both are negative and has not yet turned positive, in fact the losses have increased. This is a concern, however with effective management these can turn to positive in the long run.

Glenmark IPO–Subscribe or Not?

Yes, We recommend you to subscribe to Glenmark Life Sciences IPO. Looking at its Financials and Credit Rating historically, the prospects of this company look bright and promising.

Stock Market Tip– Do subscribe to Glenmark Life Sciences IPO

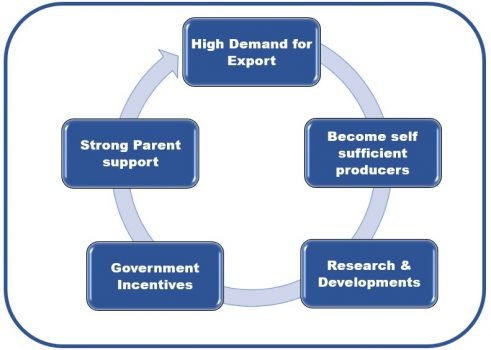

Strengths of Glenmark

- Growing export demand for APIs globally

- Supply chain interruptions with China on account of the COVID-19 crisis

- The Indian government has set up a production linked incentive (“PLI”) package focusing on APIs and the API Parks scheme to boost competitiveness of India’s manufacturing and promote domestic manufacturing of critical intermediates and APIs Strong liquidity position and profitable company with substantial growth YoY

- Research & Developments undertaken to produce quality products at low cost

- Strong Parent background & support

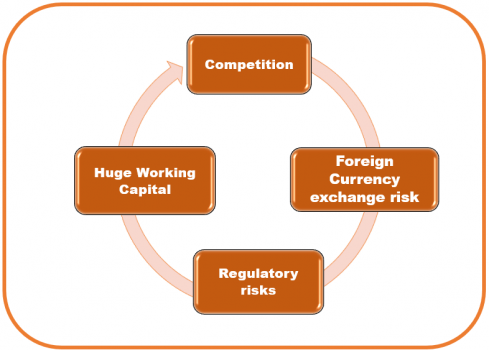

Challenges of Glenmark

- Strong competition from established competitors in the market

- Foreign currency exchange risk

- Huge working capital requirement- need to maintain high inventory and long credit period

- Regulatory risks due to change of any regulations abroad or in India since they have to strictly be compliant to all the regulatory inspections and audits.

The strengths listed overweighs the challenges called out. Thus, we highly recommend subscribing to Glenmark Life Sciences IPO

Glenmark IPO–Short term or Long-Term?

We recommend holding Glenmark Life Sciences IPO shares for the long term. As exports of APIs will increase as dependence on China reduces. Thus, holding for the long term will help you multiply your money. These shares also look good from receiving Dividends. Holding these for the short term might only give you listing gains.

Smart Finance Tip – Buy and Hold these shares for the long term. Allocate 10% of your portfolio to this stock.

Disclaimer – Investing in the stock market is subject to market risk, thus kindly consult your financial advisor before investing.

Buy Knee cap to reduce knee pain/exercise/cycling