While cooking, you need to use ingredients specific to the cuisine. You also need to use the right quantity of ingredients for good taste similarly different Ratios reflect upon the functional performance of a company and determine its long-term value. Thus Profitability Ratio Analysis helps to highlight the financial health of the company. Ratios are further split into Profitability & Balance sheet ratios. Profitability ratios are also termed liquidity ratios as it reveals the liquidity position of any company.

Profitability ratios

Profit is a yardstick to measure the performance of a company. Thus various metrics that are used to measure how profitable the business is? Ratio analysis is one of the metrics used to measure the performance of the business. Profitability ratios are useful to identify trends, financial health, and futuristic financial projections of the business.

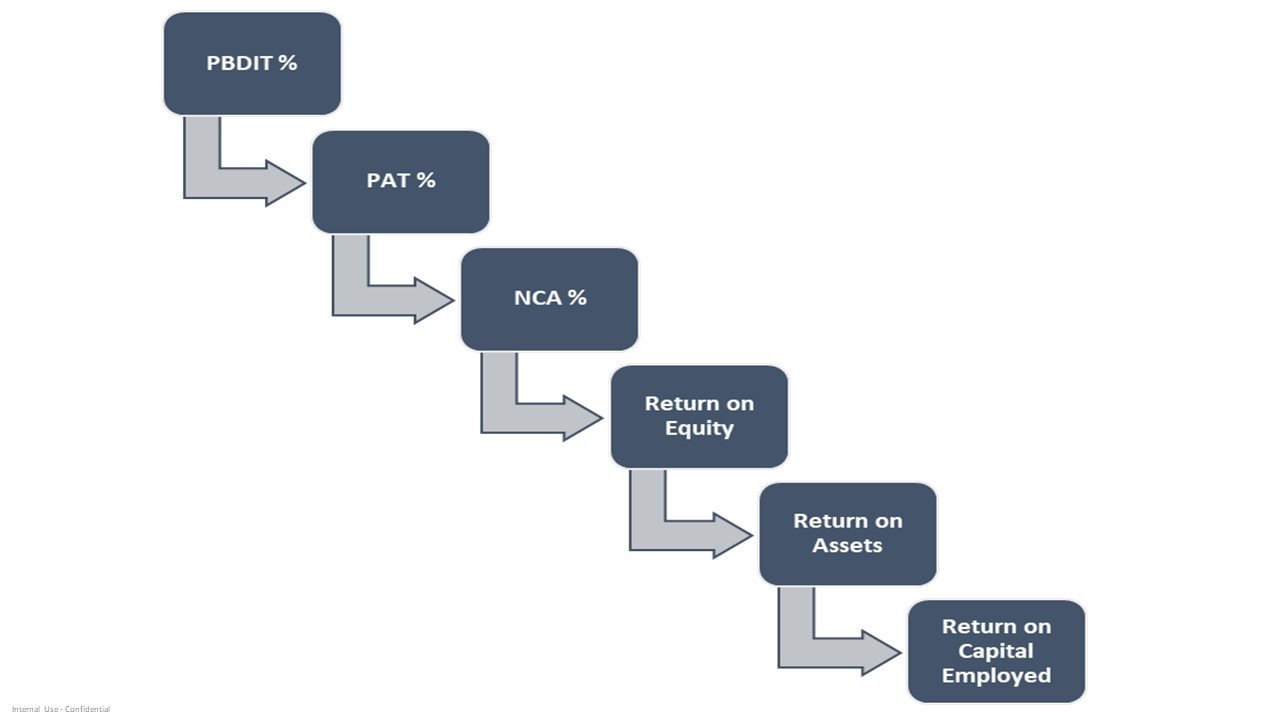

- Profit before depreciation, taxes, and interest expense (PBDIT %) – PBDIT x 100 / Sales. Higher the PBDIT %, thus higher the operating profitability of the company.

- Profit after tax (PAT %) – Net Profit x 100 / Sales. High PAT %, higher the profitability of the company.

- Return on Equity (ROE) – Net Income / Shareholder’s Equity or Net worth. Measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

- Net cash accruals (NCA %) – Net Cash Accruals (PAT + Dep) x 100 / Sales – Higher NCA %, thus Higher cash profits of the company.

- Return on Assets (ROA) – Net Income / Total Assets. Indicates how profitable a company is relative to its total assets.

- Return on Capital Employed (ROCE) – PBDIT / (Total Assets – Current Liabilities). Indicates the efficiency and profitability of a company’s capital investments

FunFacts

- In 1931 Foulke was the first one to create and promote his own set of financial ratios.

- The reason for the development of ratio analysis was its use in the analysis of the properties of ratios in 300 B.C.

Let us know if you want to study financial analysis in detail then do contact us below